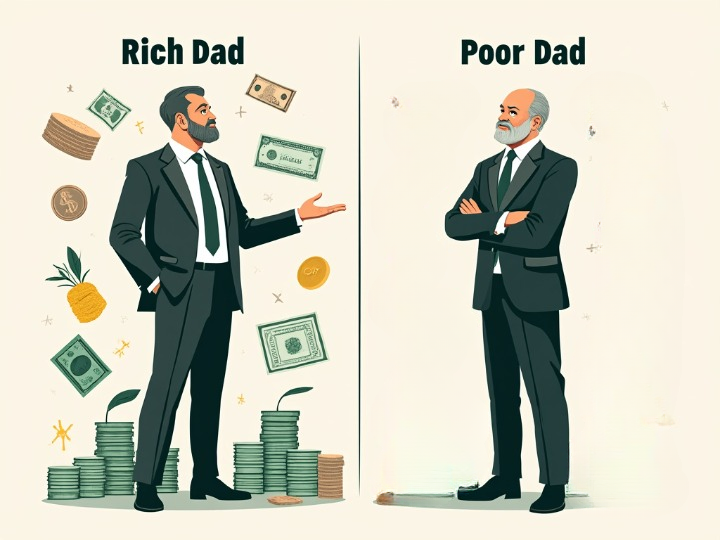

Robert Kiyosaki’s Rich Dad Poor Dad offers a unique perspective on personal finance and wealth-building. The book contrasts the financial philosophies of two father figures in Kiyosaki’s life—his biological father, referred to as the “Poor Dad,” and his best friend’s father, the “Rich Dad.” Through this comparison, Kiyosaki reveals key lessons about money, financial literacy, and the mindset needed for financial success. This summary of Rich Dad Poor Dad will explore the essential concepts from the book and how they can be applied in everyday life.

At the heart of this summary of Rich Dad Poor Dad, Kiyosaki emphasizes that wealth isn’t determined by income but by how you manage your money. The “Poor Dad,” who has a stable job, believes in working hard, getting a secure job, and relying on a pension for retirement. Conversely, the “Rich Dad” promotes the idea of making money work for you, encouraging entrepreneurship, investments, and financial education. These two conflicting ideologies form the basis for Kiyosaki’s lessons throughout the book.

Financial Literacy and the Wealth Mindset

One of the critical messages in this summary of Rich Dad Poor Dad is the importance of financial literacy. Kiyosaki explains that schools teach children how to work for money but not how to make money work for them. The book introduces concepts like assets and liabilities, explaining that many people fall into the trap of accumulating liabilities, such as cars and houses, which they mistakenly view as assets. A true asset, according to Kiyosaki, is something that puts money into your pocket, while a liability takes money out.

This focus on financial literacy is a key component of the Rich Dad Poor Dad analysis. It’s not enough to earn a high income; you need to know how to manage and invest that income to grow your wealth. The “Rich Dad” encourages Kiyosaki to learn about investing in assets such as real estate, stocks, and businesses. In contrast, the “Poor Dad” believes in job security and a steady paycheck, which limits financial growth.

The Importance of Entrepreneurship

Another crucial element of this summary of Rich Dad Poor Dad is the emphasis on entrepreneurship. Kiyosaki’s “Rich Dad” teaches him that to become truly wealthy, one must not rely solely on a job but should create opportunities through business ventures. This mindset encourages readers to think beyond traditional employment and explore ways to generate passive income. Kiyosaki explains that starting a business or investing in income-generating assets gives you more control over your financial future.

In this rich dad poor dad cliff notes, the author illustrates how entrepreneurship fosters creativity and self-reliance. Kiyosaki learned early on from his “Rich Dad” that risk-taking and learning from mistakes are essential for building wealth. While the “Poor Dad” adhered to a risk-averse, conventional approach to money, the “Rich Dad” taught him that taking calculated risks and constantly seeking opportunities for growth are what set successful people apart.

The Power of Investing

This summary of Rich Dad Poor Dad would be incomplete without discussing one of the book’s central themes: investing. Kiyosaki advocates for early and continuous investments in assets that generate passive income. By doing so, individuals can achieve financial independence. Eventually, they can have their money work for them rather than the other way around. Kiyosaki argues that people who depend solely on their salaries are trapped in the “rat race.” They constantly work harder without getting ahead financially.

In his Rich Dad Poor Dad book summary, Kiyosaki stresses that investing is a long-term game. The “Rich Dad” emphasizes that it’s not about making quick money. It’s about creating a system where your assets consistently generate income over time. He encourages people to think like investors. They should continually seek out opportunities in real estate, stocks, or businesses that provide long-term value.

Breaking Free from the Rat Race

A central lesson in the summary of Rich Dad Poor Dad is the concept of breaking free from the “rat race.” In this cycle, individuals work for money without gaining financial freedom. Kiyosaki explains that the “Rich Dad” believes in building a portfolio of assets that generate income. This allows a person to step away from the cycle of relying solely on wages. In contrast, the “Poor Dad” is focused on job security and climbing the corporate ladder. This often leads to financial dependence on employers.

Kiyosaki illustrates that achieving financial freedom requires a shift in mindset. In his Rich Dad Poor Dad analysis, he highlights how individuals can break away from the traditional path. They can do this by focusing on investments and entrepreneurship. By doing so, they can create multiple streams of income and work toward financial independence.

Final Thoughts on Financial Independence

In this summary of Rich Dad Poor Dad, the book’s overarching message is that financial independence is attainable through education, investment, and the right mindset. Kiyosaki stresses the importance of being proactive in building wealth, taking control of one’s financial future, and constantly seeking opportunities to grow financially. He teaches that true wealth comes from understanding how money works and using that knowledge to create opportunities.

If you’re looking for more insights into this life-changing book, you might be interested in reading The Great Gatsby by F. Scott Fitzgerald as well.

More Book Reviews are HERE.

Read Free Book on NFTBOOKS platform.

For anyone interested in learning the core principles of wealth-building, entrepreneurship, and financial literacy, Rich Dad Poor Dad offers invaluable lessons. This rich dad poor dad cliff notes provides a glimpse into the contrasting mindsets of the “Rich Dad” and “Poor Dad” and encourages readers to adopt a more proactive, educated approach to managing money.

Rich Dad Poor Dad has become a cornerstone in financial education, inspiring millions to rethink how they handle money and invest in their future.