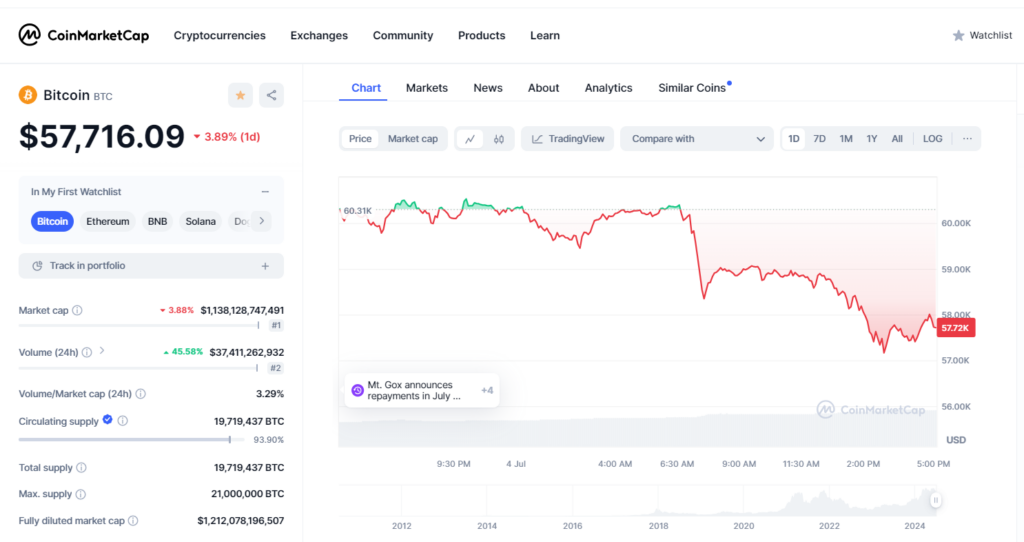

In a significant turn of events, Bitcoin has recently fallen below the $58,000 mark, a development that has captured the attention of investors and financial analysts worldwide. This drop comes on the heels of an announcement of repayment from Mt. Gox, the infamous cryptocurrency exchange, that it will begin repayments to creditors in July 2024. This long-awaited development is stirring considerable discussion within the cryptocurrency community, given Mt. Gox’s historic collapse and its lingering impact on the market.

Understanding the Mt. Gox Saga

To fully appreciate the implications of the Mt. Gox announcement, it is essential to revisit its history. Mt. Gox was once the world’s largest Bitcoin exchange, handling over 70% of all Bitcoin transactions globally. However, in 2014, the exchange experienced a catastrophic hack, resulting in the loss of approximately 850,000 Bitcoins, worth billions of dollars at today’s prices. This incident not only devastated the exchange but also sent shockwaves through the fledgling cryptocurrency market.

The fallout from the Mt. Gox collapse led to a protracted legal and financial battle. Creditors have been waiting for nearly a decade for resolution and compensation. The announcement in June 2024 that Mt. Gox would begin repayments in July 2024 marks a pivotal moment in this long-standing saga.

Analyzing the Market Reaction on Mt. Gox Repayment

The immediate reaction to the Mt. Gox repayment announcement has caused a noticeable dip in Bitcoin’s value. This drop has pushed Bitcoin below the $58,000 threshold. Several factors likely contribute to this decline. First, the anticipated influx of Bitcoin into the market, as creditors receive repayments, could lead to increased selling pressure. With such a substantial amount of Bitcoin involved, this potential liquidation raises concerns. Investors worry about market stability and increased price volatility.

Additionally, the psychological impact of the Mt. Gox repayments is significant. The exchange’s collapse remains a dark chapter in cryptocurrency history, casting a long shadow. The prospect of resolving this monumental issue brings both relief and anxiety. Stakeholders now question the broader implications for the market.

Potential Implications for the Cryptocurrency Market

From a professional financial perspective, the Mt. Gox repayments hold several potential implications for the cryptocurrency market:

- Increased Volatility: As creditors begin receiving their Bitcoin, the market could experience heightened volatility. Some creditors may choose to sell their Bitcoin immediately, leading to short-term price fluctuations. Investors should brace for potential market turbulence in the coming weeks.

- Market Sentiment: The Mt. Gox announcement could influence market sentiment. While some investors might view the repayments as a step toward resolving one of the market’s biggest crises, others may worry about the impact of sudden large-scale liquidations. This mixed sentiment could create uncertainty and affect trading behaviors.

- Regulatory Scrutiny: The resolution of the Mt. Gox case may attract renewed attention from regulators. Governments and regulatory bodies could scrutinize the process to ensure compliance and transparency, potentially leading to new regulatory measures aimed at preventing similar incidents in the future.

- Long-Term Confidence: Successfully executing the repayments could bolster long-term confidence in the cryptocurrency market. Demonstrating that even the most complex and challenging issues can be resolved may reassure investors and contribute to the maturation of the market.

Expert Opinions and Unbiased Analysis

Financial experts have weighed in on the Mt. Gox announcement, offering a range of insights and opinions. Some analysts believe that the market is overreacting to the news, suggesting that the actual impact of the repayments might be less severe than anticipated. They argue that many creditors have already planned their strategies and that the market has had ample time to absorb the potential impact.

Others, however, caution against underestimating the significance of the repayments. They point out that the sheer volume of Bitcoin involved could disrupt market equilibrium, at least temporarily. These experts advise investors to adopt a cautious approach, monitor market developments closely, and avoid making impulsive decisions based on short-term fluctuations.

Conclusion

The announcement of Mt. Gox repayments in July 2024 marks a watershed moment for the cryptocurrency market. This event brings both opportunities and challenges. As Bitcoin hovers below the $58,000 mark, investors should remain vigilant. They are advised to adopt a strategic approach to navigate potential turbulence. While the market may face short-term fluctuations, resolving the Mt. Gox saga could be beneficial. Ultimately, it may contribute to the maturity and resilience of the cryptocurrency ecosystem.

More blogs are HERE.