Introducion

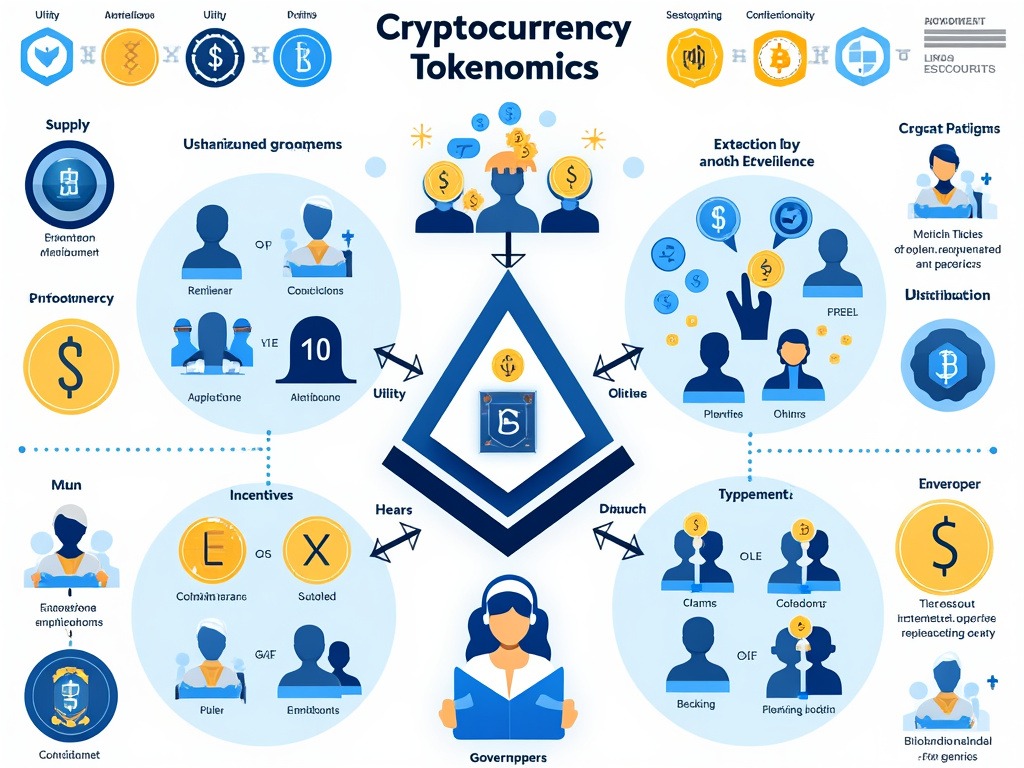

In the world of cryptocurrencies, one term consistently emerges when discussing the value and structure of a crypto project: tokenomics. This concept plays a critical role in shaping the success or failure of a cryptocurrency. In simple terms, tokenomics refers to the economics behind a token, including its creation, distribution, supply, and demand. As the cryptocurrency space grows, understanding tokenomics has become essential for investors, developers, and enthusiasts alike.

What is Tokenomics in Crypto?

At its core, tokenomics is a combination of two words: “token” and “economics.” It describes how a cryptocurrency or token is designed, governed, and utilized within a blockchain ecosystem. When exploring what tokenomics is in crypto, you’ll find it includes various factors such as token supply and inflation or deflation mechanisms. It also covers distribution strategies and the token’s utility within a network. In many ways, tokenomics is what separates successful projects from failed ones by ensuring a sustainable and functional economy.

Tokenomics is fundamental in determining how users interact with a token. It influences behavior, incentivizing users to either hold, spend, or trade a token. For example, a well-designed tokenomic model can motivate long-term holding by offering rewards or ensuring limited token supply, creating scarcity. On the other hand, poorly planned tokenomics can lead to issues like inflation, where an excessive supply of tokens dilutes their value. It can also result in a lack of incentives for users to hold onto the tokens.

Key Elements of Tokenomics

When discussing tokenomics, there are several key components to consider:

- Token Supply and Distribution: One of the primary factors in tokenomics is the supply of tokens. There are generally two types of supply—total supply and circulating supply. The total supply is the maximum number of tokens that can ever exist. In contrast, the circulating supply refers to the tokens currently available in circulation. A well-balanced distribution strategy ensures that tokens are gradually spread out over time. This approach helps prevent large holders from dumping their tokens all at once, which could crash the market.

- Utility: The usefulness of a token is central to its tokenomics. Some tokens serve as a form of currency, while others may grant governance rights, allow for staking, or provide access to certain features within a blockchain ecosystem. Strong utility creates demand, which positively impacts a token’s value.

- Incentives: Tokenomics often includes reward mechanisms to encourage certain behaviors. These can involve staking tokens to secure a network or holding them to receive a share of profits. These incentives play a crucial role in the long-term success of a project, as they create a loyal user base and reduce token volatility.

- Inflation vs. Deflation: A critical aspect of tokenomics is whether the token supply is inflationary or deflationary. Inflationary tokens increase in supply over time, much like fiat currencies. This can lead to a decrease in value if demand doesn’t keep up. Deflationary tokens, on the other hand, have mechanisms like burning, where tokens are permanently removed from circulation, creating scarcity and potentially driving up value.

How Does Tokenomics Work?

Tokenomics functions through a blend of economic principles and blockchain mechanics. It focuses on creating incentives that influence user behaviors within a cryptocurrency ecosystem. By strategically managing token supply, demand, and distribution, developers shape a system where participants are motivated to hold and stake the token. This encourages trading or engaging with the token in other ways. For instance, scarcity can be created by limiting the total supply of tokens. Alternatively, a deflationary model can be implemented where tokens are burned or removed from circulation over time. Simultaneously, reward systems, such as staking incentives or governance rights, give users tangible benefits and decision-making power within the network. By aligning these economic factors with the technical infrastructure of blockchain, tokenomics not only enhances the value of the token but also builds a stable, engaging ecosystem where users are continually incentivized to remain active participants.

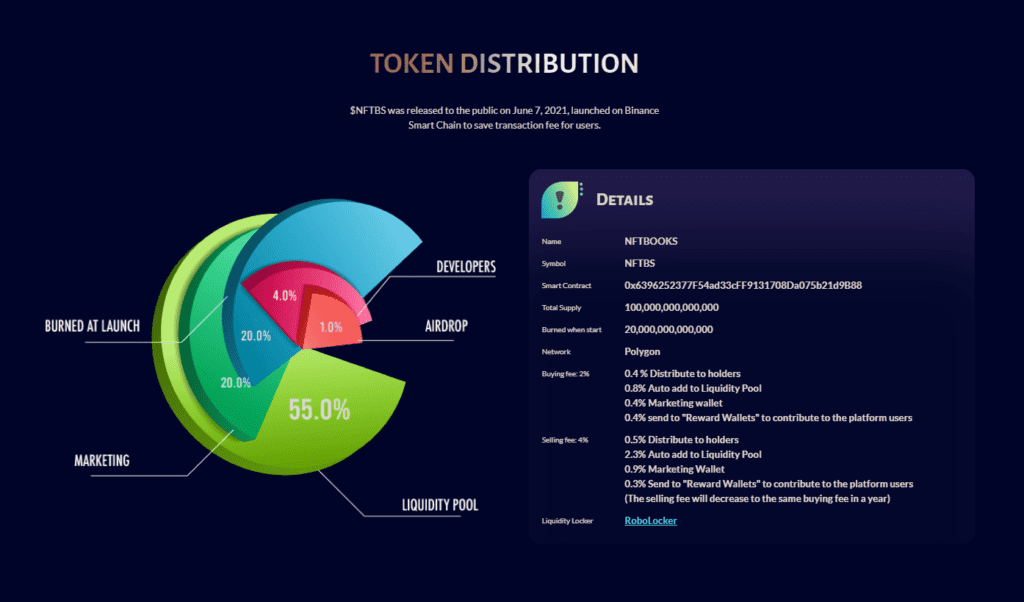

Example: NFTBOOKS Tokenomics

A practical example of deflationary tokenomics can be seen in NFTBOOKS, a platform that uses tokens to buy, sell, rent, and borrow books. NFTBOOKS initially had a total supply of 100,000,000,000,000 tokens, but 20,000,000,000,000 were burned at launch, making it a deflationary model. To date, 24.47% of the total supply has been burned, reducing the circulating supply and contributing to scarcity.

The tokenomics of NFTBOOKS involves both buying and selling fees. For buying transactions, a 2% fee is applied, distributed as follows: 0.4% goes to holders, 0.8% is added to the liquidity pool, 0.4% is sent to the marketing wallet, and 0.4% is contributed to reward wallets for platform users. For selling transactions, a 4% fee is applied: 0.5% goes to holders, 2.3% is added to liquidity, 0.9% goes to marketing, and 0.3% is sent to reward wallets.

The deflationary nature of NFTBOOKS ensures that as tokens are burned, the value of the remaining tokens may increase over time. Additionally, incentives are provided to existing holders on every transaction, encouraging long-term engagement and stability within the platform’s ecosystem.

How to Understand Tokenomics

Understanding tokenomics requires analyzing the key elements that govern a token’s value and utility within its ecosystem. First, evaluate the token’s supply structure, such as its total and circulating supply, and whether it has deflationary or inflationary mechanics, as these factors affect scarcity and value stability. Then, examine the token’s utility—its intended function in the project. Tokens with clear, practical uses are more likely to achieve strong demand. Also, look at incentive mechanisms: projects that reward holders with dividends, staking, or governance privileges often see greater user retention. Finally, consider the distribution model, which influences the token’s market stability and potential price volatility. When combined, these components reveal the sustainability and growth potential of a cryptocurrency, helping investors and developers make informed decisions within a rapidly evolving digital asset landscape.

Why Tokenomics Matter for Investors

For investors, understanding tokenomics is crucial when deciding which cryptocurrency projects to back. Analyzing the tokenomics model allows investors to gauge whether a project has long-term potential. For example, if a project’s token has a clear use case and limited supply, it may represent a sound investment. Additionally, incentives for holding can further enhance its attractiveness. On the flip side, weak tokenomics can result in oversupply and price instability. These issues, along with a lack of user adoption, can spell trouble for the value of a token.

When exploring what is tokenomics in crypto, it’s also essential to understand governance. Some tokens give holders voting rights on important project decisions, such as how funds should be allocated or which features should be developed next. This creates a decentralized form of governance that allows users to have a say in the direction of the project, making them more engaged in the ecosystem.

Tokenomics and Blockchain Development

Tokenomics doesn’t just affect investors; it’s also critical for developers building on blockchain platforms. When designing a cryptocurrency, developers must carefully consider how tokenomics will support the long-term health of the network. Without a solid economic model, even the most innovative projects can fail. Tokenomics ensures that there are enough incentives for participants to secure the network, validate transactions, and use the token within the ecosystem.

Moreover, tokenomics plays a role in the broader cryptocurrency market. It determines how a token interacts with exchanges, how it can be traded, and how it can be integrated into decentralized applications (dApps). A well-thought-out tokenomic structure can lead to increased adoption and integration, further boosting the token’s value and utility.

Final thought: The Future of Tokenomics

As the cryptocurrency space evolves, so too will the concept of tokenomics. It is likely that more sophisticated models will emerge, offering new ways to incentivize users and create sustainable economies within blockchain ecosystems. Investors and developers who take the time to understand tokenomics will be better positioned to succeed in this dynamic market.

You might be interested in reading this Real World Asset Tokenization as well.

In the end, whether you’re an investor looking for the next big project or a developer building the future of decentralized finance, understanding tokenomics is key to navigating the world of cryptocurrency. By paying attention to token supply, distribution, utility, and incentives, you can make informed decisions that will serve you well in this rapidly changing landscape.

With a robust grasp of tokenomics, you’re not only gaining insight into a single project but into the entire ecosystem of blockchain and cryptocurrency.