The cryptocurrency market is buzzing with concern following the recent announcement from the trustee of the defunct Mt. Gox crypto exchange. The trustee has confirmed that over 140,000 BTC, which were stolen during a 2014 hack, will begin to be returned to clients starting in July. This news has caused a significant dip in Bitcoin prices, sparking fears of a potential market downturn. However, some analysts suggest that the impact might not be as severe as anticipated.

Introduction

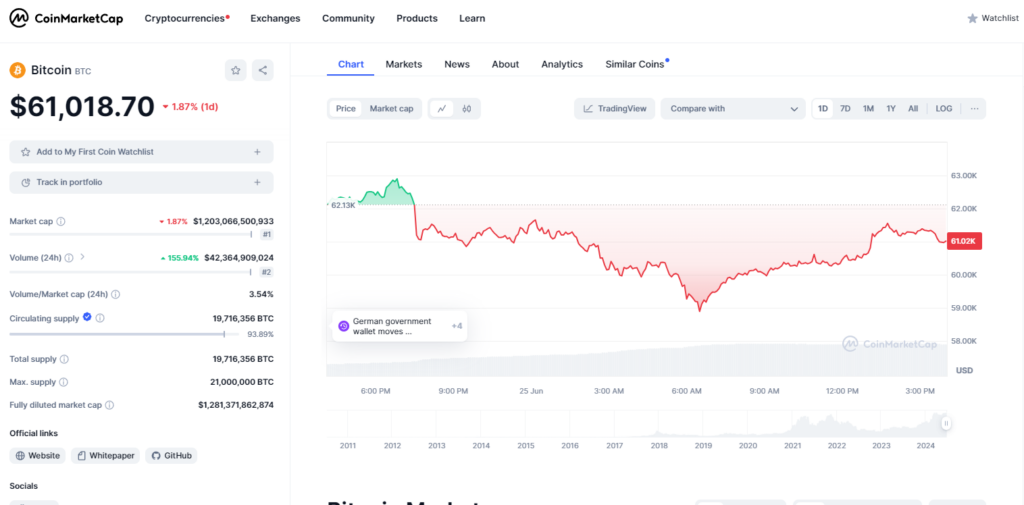

Bitcoin (BTC) is experiencing a notable decline, currently trading at $60,700—a drop of over 5% within the past 24 hours, marking its lowest point since early May. This decline has affected other major cryptocurrencies as well, including Ethereum (ETH) and the broader CoinDesk 20 Index. The primary concern among investors is the impending release of over 140,000 BTC from the Mt. Gox settlement, which many fear could flood the market and drive prices down further.

The Mt. Gox Context

The Mt. Gox exchange, which once handled over 70% of all Bitcoin transactions globally, collapsed in 2014 after a massive hack led to the loss of approximately 850,000 BTC. Since then, the long process of asset recovery and distribution has been ongoing. The announcement that these assets will soon be returned to creditors has stirred concerns about the market’s ability to absorb such a large influx of Bitcoin without significant price disruption.

Analysis: Market Impact and Investor Sentiment

Potential Market Pressure

The concern is understandable: releasing 140,000 BTC into the market could theoretically exert substantial downward pressure on Bitcoin’s price. To put this into perspective, this amount is just shy of Fidelity’s spot Bitcoin ETF holdings, which stands at 167,375 BTC. The fear is that a sudden sell-off by the recipients of these coins could lead to a significant drop in Bitcoin prices, triggering broader market instability.

Analyst Perspectives

However, not all experts share this bleak outlook. Alex Thorn, head of research at Galaxy, offers a more nuanced perspective. Thorn’s research indicates that fewer coins will be distributed than initially feared, which could mitigate the expected sell pressure. Specifically, he estimates that about 75% of creditors will opt for the “early” payout option in July, resulting in the distribution of approximately 95,000 BTC.

Thorn further believes that only around 65,000 BTC will go to individual creditors, many of whom he expects to hold onto their coins rather than sell them immediately. These individuals, having endured years of waiting and resisted numerous buyout offers, may be less inclined to liquidate their assets quickly. Additionally, the significant capital gains taxes on the appreciated Bitcoin may deter immediate sales.

Claims Funds Dynamics

Moreover, Thorn’s discussions with various claims funds suggest that most of their partners are high-net-worth individuals looking to accumulate Bitcoin at a discount rather than seeking quick profits. This implies a lower likelihood of immediate large-scale sell-offs, as these investors are more likely to adopt a long-term holding strategy.

Implications of Mt. Gox News for the Crypto Market

- Short-term Volatility: The announcement has already led to a noticeable dip in Bitcoin prices, and further volatility is expected as the distribution date approaches. Traders should brace for potential price swings and consider their strategies accordingly.

- Long-term Stability: If Thorn’s analysis holds true, the long-term impact on Bitcoin’s price may be less severe than feared. A more gradual release and retention of coins by creditors and claims funds could help maintain market stability.

- Regulatory Scrutiny: This situation underscores the importance of regulatory frameworks in managing the distribution of large cryptocurrency holdings. Increased transparency and regulatory oversight could help mitigate market disruptions in similar scenarios.

For those interested in the broader implications of this development and the potential opportunities in the cryptocurrency space, consider exploring the innovative projects within the blockchain ecosystem. One such project is NFTBOOKS, which leverages blockchain technology to revolutionize the publishing industry. To learn more about how NFTBOOKS is transforming the way we engage with digital content, visit our blog.

Conclusion

While the Mt. Gox news has undoubtedly stirred concerns within the crypto market, it’s essential to approach the situation with a balanced perspective. Careful analysis and understanding of the distribution dynamics suggest that the feared market impact might be less dramatic than anticipated. As always, staying informed and considering the long-term potential of blockchain projects can help investors navigate these uncertain times.